Overview

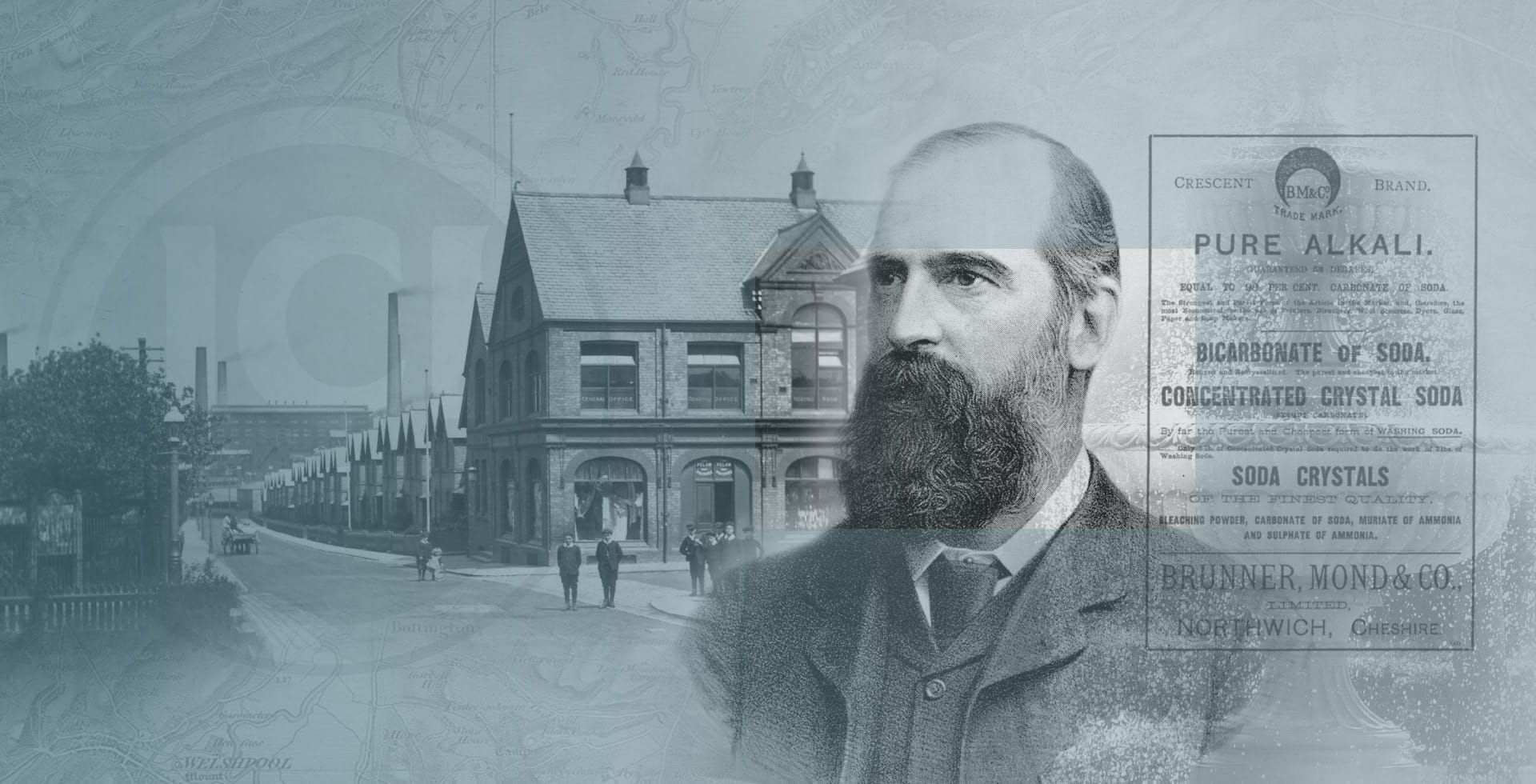

Managed by Allianz Global Investors, The Brunner Investment Trust is not restricted to any one country or sector and has been investing for the long term since 1927. Brunner invests in companies all over the world, seeking out the best opportunities for growth and reliable dividends wherever they may be.

Supported by its experienced co-lead Portfolio Managers, Julian Bishop and Christian Schneider, Brunner combines investment expertise across the globe with a proven track record of performance, making it a reputable choice for those seeking exposure to global equities.

Investment capabilities / approach

The Brunner Investment Trust is an actively managed diversified portfolio, where its portfolio managers constantly make long-term strategic investment decisions. The Trust is not restricted by country or industry, so can seek out what they believe should be the best opportunities for growth and income, wherever they may be.

The Trust’s key capabilities include:

- Global access to companies with long-term growth potential: the Trust is not restricted to any one country or sector and seeks out the best opportunities for growth and reliable dividends wherever they may be.

- Comprehensive investment approach: covering all sectors and countries ensuring diversified exposure and a broad range of investment opportunities.

- Expert management: the Trust is led by a skilled team that focuses on professional oversight and strategic decision-making.

- 52 consecutive years of dividend growth: although income is not guaranteed and could go down as well as up, the Trust has paid increasingly higher dividends to its shareholders year-on-year for the past 52 years.

- A balanced approach to investing: the Trust combines a history of careful investing with an adaptable strategy to create shareholder value and achieve long-term objectives.